A raft of recent tax changes has left major question marks over the ongoing profitability of (Residential) Buy-to-Let. But is the golden age of BTL really over and if so, will investors now turn their attention to commercial property … and property-backed P2P lending in particular.

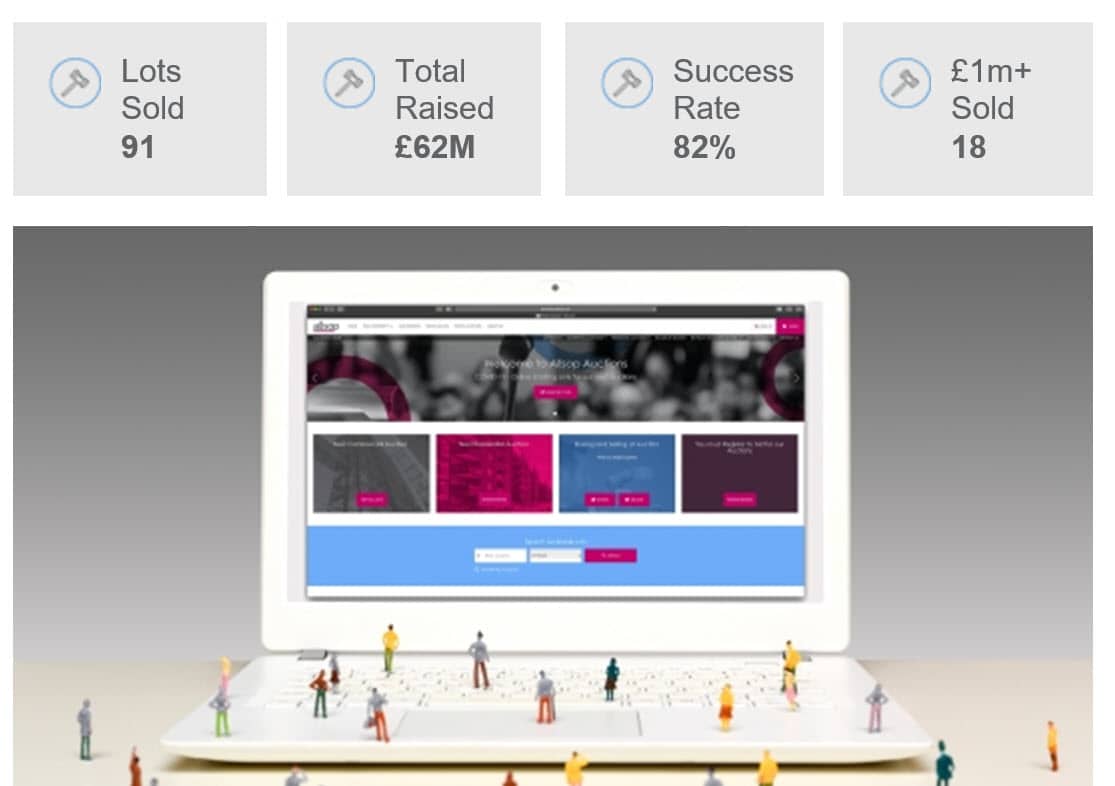

According to recent research from the National Landlords Association, 20% of its members plan to reduce the number of properties in their buy-to-let portfolio over the course of the next year – the highest level of intended property sales in 10 years. Conversly, commercial property auction house Allsop, reported that 82% of investors intend to buy more commercial property over the same period.

This positive outlook for the domestic commercial property market would seem to be supported by Real estate advisor Colliers International, who themselves recently announced that UK commercial property transactions had reached £55bn in 2017 and are expected to exceed £50bn for the sixth consecutive year in 2018.

——————————————————-

Brian Bartaby, founder and CEO of Proplend, believes that whilst sterling remains competitive against the US dollar, we can expect new entrants to the market, particularly from Asia, looking to buy UK commercial assets.

“In this current long term, low interest rate environment, investors are attracted to stable yields. The current five-year outlook for commercial property from Savills shows an average rental growth of 1.9% per annum and then there’s the fact that average FRI lease lengths are considerably longer than residential BTL’s”, states Bartaby.

But with commercial property investing being a specialist field and ‘different animal’ to residential property investing, for many it’s not going to just be a case of switching the focus of their BTL activities. Those looking looking to pursue commercial property-backed investment opportunities might want to consider a ‘first in line’ debt position over the equity position they had been holding in the residential world, as the Proplend CEO explains:

“Barring a black swan event, we predict that commercial property values will remain relatively flat in the short to medium term – a great environment for the Real Estate debt investor. At sensible loan to values, stable levels of equity protect the debt position offering investors attractive rates of risk adjusted returns with high levels of capital protection.”

——————————————————-

While this asset class has traditionally been the domain of bank and institutional investors, specialist property debt platforms like Proplend have now opened these investment opportunities up to individual investors too. Compared to property owners, property debt investors take the least risk, are the first repaid and have the highest claim on loan collateral.

Commercial property borrowing facilitated through the Proplend platform is split into £1,000 parts – with Proplend’s registered investors able to participate in loans secured by a range of property types across the UK at risk-return level they’re comfortable with. A number of steps have been put in place to minimise the risk of investor loss.

In the current climate of persistently low cash interest rates, many individual savers are now looking for relatively low risk investments and are increasingly attracted to secured peer to peer lending for inflation-beating returns on their savings, SIPP and SSAS pension, and now ISA funds.

——————————————————-

Since April 2016, the new peer to peer lending ISA or ‘Innovative Finance ISA’ has been attracting an increasing share of current year ISA allowances, with accounts also funded by ISA transfers from approaching two decades of previous year subscriptions.

The penal buy-to-let tax changes are only likely to increase the swell of capital coming into the alternative investment market – it remains to be seen whether the golden age of BTL becomes the golden age peer to peer debt investment.