The simple honest answer is we can’t – not completely. But with a reputation for diligence and security, and with every loan backed by a first legal charge over commercial property assets at an average 62.5% LTV – we’ve always had half an eye on tougher times.

– – – – – – – – – – – – – – – –

‘Interest Reserve’ – A minimum three months’ interest held on every loan

None of us can predict the future and even the best laid Borrower plans have to adapt from time to time. So, incorporating loan-specific Interest Reserves across the board seemed a sensible precaution. In the event of a Borrower failing to make their scheduled interest payment, the Interest Reserve helps ensure that Lenders get paid their interest on time – every month.

The Proplend platform facilitates loans on an interest-only ‘mortgage’ basis, as well as for shorter-term, ‘bridging’ finance. In addition to the Interest Reserve, for bridge loans, a full ‘Interest Sweep’ is withheld by us from the loan principal at point of drawdown – covering all the interest due during the term of the loan.

Serviced ‘mortgage’ loans

Conversely, mortgage Borrowers are expected to service their loans throughout the term, committing to regular payments of interest – paid monthly and paid promptly. If a payment is missed, we’re immediately in contact with the Borrower and expect the Interest Reserve to be topped back up (and regular servicing to resume) as a matter of urgency – to preserve that buffer.

The Interest Reserve is not intended to be a rainy-day fund to give Borrowers breathing room or payment flexibility. Under usual circumstances it provides income certainty to investors that whatever happens their income is covered for at least the next three months. However, in unprecedented circumstances, it does afford us some scope for considering justified payment cessation requests.

A national emergency affects us all as individuals, but we know from reaching out to all our Borrowers during the last few weeks that the situation is impacting our Borrowers from a commercial perspective in different ways and to different degrees. We believe it is reasonable to listen to all requests from mortgage Borrowers where the revenue from their tenants is used to service their loan – and the Interest Reserve (operated at Proplend’s discretion) gives us a ready-made instrument, where appropriate, for supporting Borrowers through adversity outside of their control.

Temporary payment cessation requests

Historically, Proplend has always favoured loan requests where the Borrower can evidence that the lease income is comfortably in excess of their monthly interest commitments. But when the tenant is unable to occupy the premises to trade and not in a position to pay the rent as a direct result – we don’t believe that complete inflexibility from the payment terms of the loan, always results in the best outcomes for Lenders either.

Our door is always open to Borrowers, and where warranted we believe the Interest Reserve, in place for every loan, has the potential to double as a tool to help safeguard the long-term health of Lenders capital investments – as well as their short-term income interests. In our experience, ongoing, proactive dialogue with Borrowers is more effective to aid a consensual recovery process, than the last resort of a rigid enforcement.

This is not to say that all our mortgage Borrowers are requesting payment cessation, nor that all requests will be granted automatically or after due consideration. A minority of loans that were not what we’d refer to as in ‘good standing’ prior to COVID-19, can’t blame their situations entirely on the outbreak and will not be permitted to use recent developments as an excuse.

Most of our Borrowers did service their loan interest during March and while the compound effect of prolonged restrictions and uncertainty will become increasing challenging, many Borrowers have told us they expect to be able to maintain payments “as things stand”.

– – – – – – – – – – – – – – – –

Active loan updates and our exchange market

Our secondary loan exchange market is continuing to offer valuable liquidity to Lenders, for all ongoing (‘Active’) loans where interest payments are continuing as agreed (and aren’t within the final month of their term). Understandably there are more loans listed than usual and sales are taking longer than our all-time 11-hour average waiting time (prior to March). Selling a loan part at ‘par’ is naturally going to be more difficult where supply is greater and other assets are suffering depreciation.

Some Lenders have told us they’re re-evaluating the split of their overall savings and investment portfolios (including ISAs), while others we’ve spoken to have admitted to using Proplend’s liquidity to reduce their overall P2P exposure, when they can’t do likewise on other platforms. This does not represent a mass exodus by any means, and we’re not taking it personally. In fact, each Lender selling gives another a chance to invest – be it existing ISA Lenders using their subscription allowances or replaceable balances by the end of this tax year, or new Proplenders using new 2020-21 allowances or turning to investing where saving is no longer viable.

Proplend’s new messaging facility, accessed via Lender Dashboards, is adding value at a time when we’re increasing the volume of our Lender updates for all loans on the platform. Those updates and all key events in the life of each loan are then summarised in the ‘History’ section within each of your loan listings, for you and other Lenders to consider in the event the loan is made available to other Lenders during term.

If a Borrower misses an interest payment and interest is paid from the reserve, however temporary the arrears event, participating Lenders in that loan will be the first to know as usual. If any parts of that loan were on the Proplend Loan Exchange, they will automatically be removed from sale until the situation is redressed (to Proplend’s satisfaction) – again Lenders will be the first to know.

Similarly, if and when we grant our first interest payment cessation, participating Lenders will be informed in advance – because any concession must be agreed by Proplend’s Credit Committee in advance. Notification of cessation (and suspension from the PLE) will be accompanied by our reasoning for the decision.

– – – – – – – – – – – – – – – –

New loan origination and funding

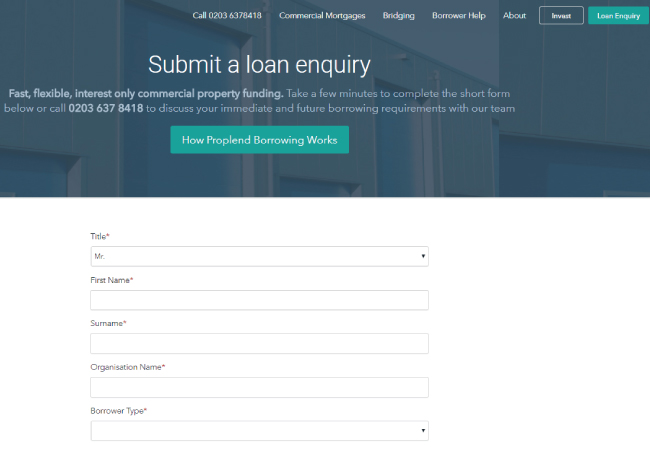

While some Lenders have suspended lending completely at this time, we are continuing to see a considerable number of new borrowing enquiries. We expect some of these enquiries to be added to our ‘pipeline’ of future investment opportunities which are at varying stages of ‘legals’. A few of the more progressed loans we expect to bring to platform during the month of April – including today’s new loan.

In the current climate, we can’t and will not pretend that it’s business as usual and it’s important to acknowledge that these are extraordinary origination and investment circumstances. It would be naïve to fund a loan today on the same basis as we did even a month or two ago. As a result, we are reviewing terms for existing pipeline loans and adapting lending criteria for future facilitation – at least until the economic lending conditions improve.

It’s a ‘Lender’s Market’ at the moment, but we’re still taking the opportunity to get feedback from as many existing Proplenders as we can – what types of loans do you want to see us bring to platform? Do you want us to continue offering mortgage loans backed by income-producing property and good interest cover ratios? Or would you prefer bridge loans with a full interest sweep and higher risk-adjusted returns for the foreseeable future. Perhaps you’d like us to continue offering a blend of both, ideally at lower LTVs?

– – – – – – – – – – – – – – – –

Maximum 50% loan to value investments available in every loan

Remember, for the more risk averse amongst you, and perhaps there are a few more of you at the moment, thanks to Proplend’s tranching system – the majority of loan parts in each loan we bring to platform are capped at 50% LTV and available via Auto-Lend. During 2019, the average annualised return (after fees) for Tranche A was 7.27% and for our first defaulted loan a few months ago, Tranche A investors have already got back all capital and expected interest and even some penalty interest for the delayed repayment.

Like any investment, capital is at risk when you invest in a Peer-to-Peer loan and the rate of return may differ from what you were expecting (if the Borrower doesn’t meet their commitments). But there are a number of precautions Proplend takes on your behalf and others you can take for yourself on platform to minimise risk – at this or any other time. That’s why we’re the top-rated P2P platform with industry specialists 4thWay and why in reference our Tranche A investments they believe; “the intrinsic risks of this kind of lending are lower than any other type of P2P property lending currently available and, indeed, any other type of non-property lending too.

Related to this post …

Read more about what Proplend does to minimise investor risk

Auto-Invest in maximum 50% LTV investments via our tax-free ISA

Blog feature: Attractive Tax-Free Returns, Capped at 50% Loan to Value

Blog feature: Why it pays to be flexible this ISA season

Proplend New Lender Offer – Ends 1 June 2020

Read 4thWay’s independent Proplend review